Donate NowDonate Online securely via PayPal using the Donate buttonBaal Dan is Tax-Exempt: Baal Dan Charities is exempt from federal income tax under section 501(c)(3) of the Internal Revenue Code. Contributions to Baal Dan Charities are deductible under section 170 of the code. Baal Dan is classified as a public charity and qualified to receive tax-deductible bequests, devises, transfers and gifts under section 2055, 2106 or 2522 of the code. Federal Tax ID/EIN: 20-4658983 Shop our merchandise at: http://www.cafepress.com/baaldan |

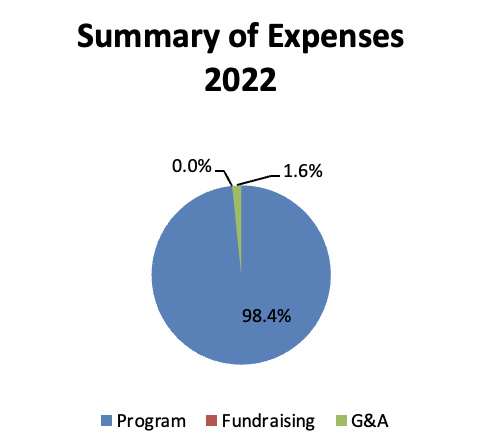

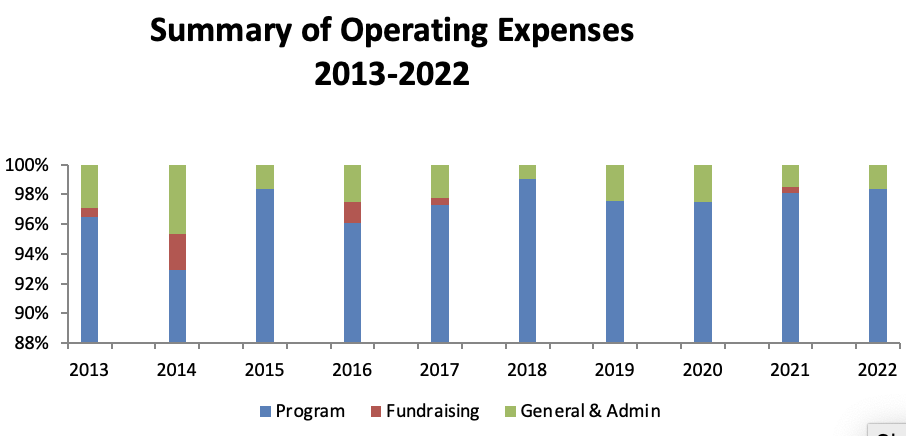

Give with confidence:Nearly 100% of what you give today will go directly into the hands of the very most needy the next calendar year. While national guidelines allow for up to 30% of donations to be spent on marketing and administrative costs, Baal Dan was able to keep those expenses under 4% in 2016.

Funds are generally dispersed in the first and fourth quarters of the year. |

Support Our Administrative Costs

We rely on the pro bono help of unpaid volunteers to keep our costs low and we try to personally subsidize costs (e.g. travel) as much as possible. If you or your organization is interested in helping to fund administrative costs or provide pro bono professional services that will enable us to scale and help more children, please email us.

We rely on the pro bono help of unpaid volunteers to keep our costs low and we try to personally subsidize costs (e.g. travel) as much as possible. If you or your organization is interested in helping to fund administrative costs or provide pro bono professional services that will enable us to scale and help more children, please email us.

Donate by check or money orderIf at all possible, we prefer that you donate online using the PayPal button above. This saves us administrative time and processing and you'll receive your receipt immediately. If you need to donate by check or bank wire, make checks payable to “Baal Dan Charities.” For our mailing address,

simply email us. |

Does your company match gifts?It's easy to enroll Baal Dan in your company's gift matching program. Companies which already match gifts to Baal Dan include AT&T, Esurance, Wells Fargo, Microsoft, Tellabs, ING, Liberty Mutual, eBay, and more.

If your company requires more information or IRS 501c3 verification, simply email us. |